Look-Back Measurement Periods

Affordable Care Act > Look-Back Measurement Periods

The Look-Back Measurement Period List page lets you define one-to-many measurement periods for Affordable Care Act reporting. Use multiple measurement periods if you define different periods for different employee groups.

A key provision of the Affordable Care Act is the employer-shared responsibility, which requires an employer to offer health care coverage to all full-time employees. Full-time employees are employees who work 30 or more hours a week.

The regulations offered two methods for determine and employee’s full-time: monthly measurement and look-back measurement.

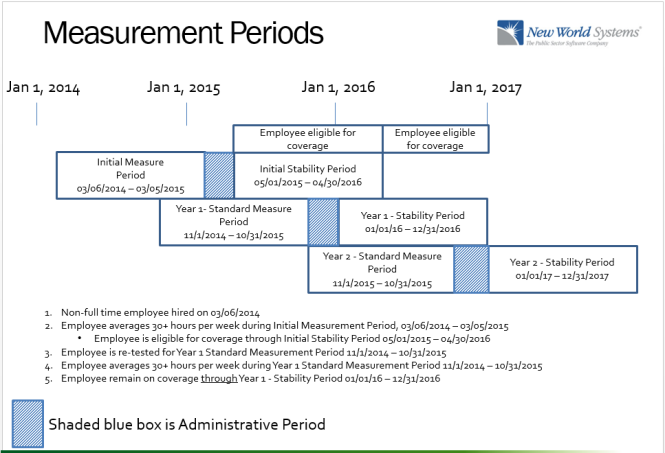

With look-back measurement, employers may choose a time period to evaluate employees to determine the employee’s status.

Employees then maintain their status during the following stability period.

What you need to determine are whether different initial measurement periods apply to different employee groups and what hours codes are applicable to an hour of service.

An hour of service is composed of the following:

- Hours an employee is paid for performance of duties. Includes regular pay, overtime, on-call hours.

- Hours an employee is paid (or entitled to be paid) in which no duties are performed. Includes vacation, holiday, disability, layoff, jury duty, military leave and leave of absence.

Define hours codes through configuration.

Salary pay type employees are credited with their daily hours, for each day in a payable status.

What you need to determine to report on an employee's initial measurement period:

- When the initial measurement period starts.

- The initial measurement period length,

- How a new hire/rehire is identified.

Benefit groups are the key driver for reporting work hours:

- Employees, statutory employees, statutory non-employees independent contractors should be in different benefit groups.

- Employee groups that have different measurement periods need to be in different benefit groups.

- Employees who are expected to average at least 30 hours per week are considered full-time and should be assigned to a full-time benefit group.

- Employees who are expected to average less than 30 per week are considered not full-time and should be assigned to a non full-time benefit group.

-

Look-back measurement reports use “near” real-time data, using a data deployed with the base New World ERP application, similar to the DSS data mart.

-

The reports are run out of New World ERP, similar to all standard New World ERP reports.

-

The report footer includes information on the last data refresh.

An installer has been created for the Reporting Data Mart, and the release documentation includes instructions on installing and refreshing the data mart.

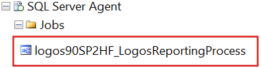

A schedule needs to be set up to process the ![]() SQL Server job nightly.

SQL Server job nightly.

During configuration, the SQL Server job may be executed manually to refresh the data mart based on configuration changes. This process should take only a few minutes to execute.

Measurement periods that already have been defined appear in a grid on the Look-Back Measurement Period List page. To edit a period, click the corresponding Code in the grid. To add a period to the grid, click the New button located in the bottom-left corner of the page. In either instance, the Look-Back Measurement Period page opens.

From http://www.irs.gov/irb/2014-9_IRB/ar05.html

Applicable large employer. The term applicable large employer means, with respect to a calendar year, an employer that employed an average of at least 50 full-time employees (including full-time equivalent employees)

Full-time employee—(i) In general. The term full-time employee means, with respect to a calendar month, an employee who is employed an average of at least 30 hours of service per week with an employer

Part-time employee. The term part-time employee means a new employee who the applicable large employer member reasonably expects to be employed on average less than 30 hours of service per week during the initial measurement period, based on the facts and circumstances at the employee’s start date.

Variable hour employee–(i) In general. The term variable hour employee means an employee if, based on the facts and circumstances at the employee’s start date, the applicable large employer member cannot determine whether the employee is reasonably expected to be employed on average at least 30 hours of service per week during the initial measurement period because the employee’s hours are variable or otherwise uncertain.

Seasonal employee. The term seasonal employee means an employee who is hired into a position for which the customary annual employment is six months or less.

Ongoing employee. The term ongoing employee means an employee who has been employed by an applicable large employer member for at least one complete standard measurement period

New employee. Under the look-back measurement method, the term new employee means an employee who has been employed by an applicable large employer for less than one complete standard measurement period

Initial measurement period. The term initial measurement period means a period selected by an applicable large employer member of at least three consecutive months but not more than 12 consecutive months used by the applicable large employer as part of the look-back measurement method

Standard measurement period. The term standard measurement period means a period of at least three but not more than 12 consecutive months that is used by an applicable large employer member as part of the look-back measurement method

Stability period. The term stability period means a period selected by an applicable large employer member that immediately follows, and is associated with, a standard measurement period or an initial measurement period (and, if elected by the employer, the administrative period associated with that standard measurement period or initial measurement period), and is used by the applicable large employer member as part of the look-back measurement method

Administrative period. The term administrative period means an optional period, selected by an applicable large employer member, of no longer than 90 days beginning immediately following the end of a measurement period and ending immediately before the start of the associated stability period.

More information: https://www.federalregister.gov/articles/2014/02/12/2014-03082/shared-responsibility-for-employers-regarding-health-coverage